極網路公司概覽:

- 核心業務:極進網路公司為企業客戶提供以軟件驅動的網路解決方案。其產品組合包括雲端管理、機器學習和人工智能,用於網路政策、分析、安全和訪問控制。公司的解決方案對包括酒店、金融服務、體育場館、零售、運輸、物流、教育、政府、醫療保健和製造業等多個行業至關重要。

- 全球業務布局:極進網路公司總部位於美國北卡羅萊納州莫里斯維爾,公司在美洲、歐洲、中東、非洲和亞太地區擁有重要的業務存在。

- 市場表現:在2024財政年度,極進網路公司報告收入為13億美元,較前一年增長18%。公司的市值約為22億美元。

財務亮點與基本面分析:

- 收入增長穩健:2024年達到13億美元,較前一年增長18%。

- 凈收入大幅增長:2024年公司報告凈收入增長顯著,較前一年增長76.4%。

- 營運利潤率:2023財政年度的營運利潤率為17.4%,反映了公司在管理其銷售相對於淨銷售的開銷方面的效率。

- 自由現金流:極進網路公司強調非GAAP自由現金流,這是衡量營運績效的一個指標。截至2023年6月30日的年度,總自由現金流為2.354億美元。

技術分析:

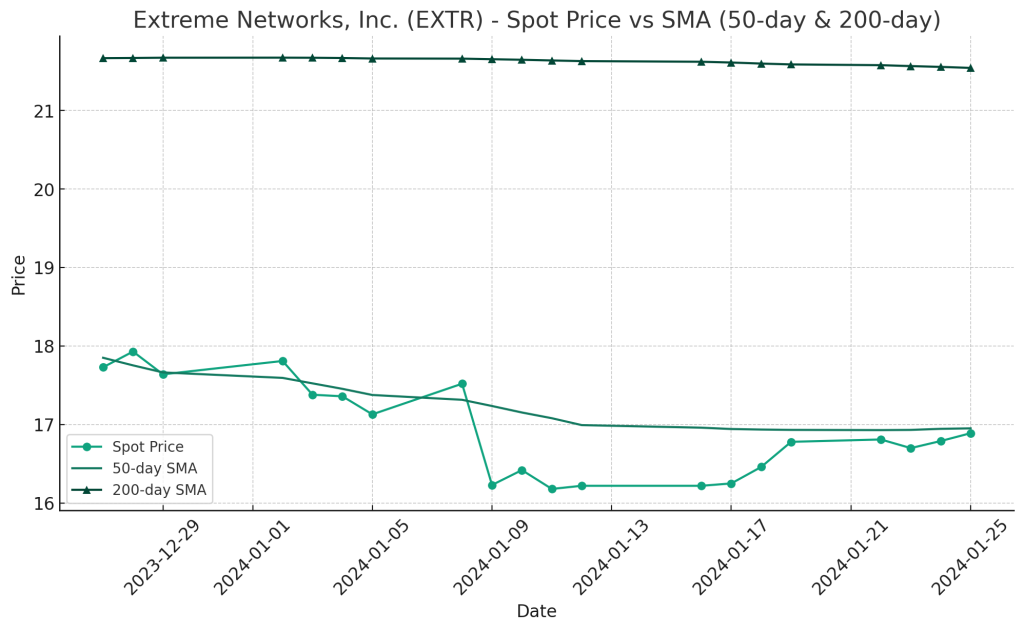

- 50日均線(SMA):$16.9515,暗示股價在短期平均價格附近徘徊。

- 200日均線(SMA):$21.54322,表明股價目前交易低於其長期平均值,可能呈現買入機會。

- 指數移動平均線(EMA) 50日:$17.60112,與目前的交易水平緊密對齊,暗示近期價格趨勢穩定。

- 相對強弱指數(RSI):48.41623,表明市場處於中立位置,既非超買也非超賣。

價格預測:

- 短期入場價格:股價接近其50日簡單移動平均線(SMA)$16.9515。考慮到近期市場動態和股價與此平均線的接近程度,可能的入場點可能在當前市場價格或略低,特別是如果價格下跌至$16.50至$16.75範圍內。

- 6個月目標價格:由於公司的強勁財務表現以及股價低於其200日SMA的$21.54322,6個月的目標價格在$20至$22範圍內似乎是可達到的。這一預測假設收入持續增長和市場條件有利。

- 長期展望:對雲網路解決方案的需求日益增加以及公司在AI和機器學習方面的創新,使極進網路公司具有潛在的長期增長潛力。如果公司繼續其當前的增長軌跡,股價可能在長期內進一步升值,有可能達到或超過其以前的高點。

未來展望與潛力:

- 雲網路增長:隨著雲解決方案的增長,極進網路公司在雲網路領域有增長潛力。

- 創新與擴展:他們對AI和機器學習的網路解決方案的重視顯示了未來增長和新市場擴展的潛力。

風險與挑戰:

- 競爭性行業:技術和通訊行業競爭激烈,技術和客戶偏好迅速變化。

- 全球經濟因素:外部經濟因素可能影響IT支出,進而影響公司業績。

- 市場波動性:作為科技股,公司容易受到市場波動的影響,可能導致股價波動。

結論: 極進網路公司是一個吸引人的投資機會,特別是對那些對技術和雲網路領域感興趣的投資者。公司的強勁財務表現以及其創新解決方案和全球業務布局,使其成為投資者的一個引人注目的選擇。然而,潛在投資者應注意與技術行業相關的固有風險和市場波動性。

Riding the Cloud Wave: Extreme Networks’ Path to Tech Triumph – A Comprehensive Investment Insight

Overview of Extreme Networks, Inc.:

- Core Business: Extreme Networks provides software-driven networking solutions for enterprise customers. Their product portfolio includes cloud management, machine learning, and artificial intelligence for network policy, analytics, security, and access controls. The company’s solutions are integral to a variety of sectors including hospitality, financial services, sports venues, retail, transportation, logistics, education, government, healthcare, and manufacturing.

- Global Presence: With headquarters in Morrisville, North Carolina, USA, the company has a substantial business presence in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

- Market Performance: For fiscal year 2024, Extreme Networks reported a revenue of $1.3 billion, an 18% increase from the previous year. The company’s market capitalization stood at approximately $2.2 billion.

Financial Highlights and Fundamental Analysis:

- Robust Revenue Growth: Demonstrated a consistent increase in revenue, reaching $1.3 billion in 2024, up 18% from the previous year.

- Strong Net Income Growth: In 2024, the company reported significant growth in net income, marking a 76.4% increase compared to the previous year.

- Operating Margin: The operating margin for the fiscal year 2023 was 17.4%, reflecting the company’s efficiency in managing its expenses relative to its net sales.

- Free Cash Flow: Extreme Networks places emphasis on non-GAAP free cash flow, which is a measure of operating performance. For the year ending June 30, 2023, the total free cash flow was $235.4 million.

Technical Analysis:

- 50-Day SMA: $16.9515, suggesting the stock is hovering around its short-term average price.

- 200-Day SMA: $21.54322, indicating that the stock is currently trading below its long-term average, which may present a buying opportunity.

- EMA (50-day): $17.60112, aligning closely with current trading levels, suggesting stable recent price trends.

- RSI: At 48.41623, indicating a neutral position in the market, neither overbought nor oversold.

Price Predictions:

- Short-Term Entry Price: The stock is trading close to its 50-day SMA of $16.9515. Considering the recent market momentum and the stock’s proximity to this average, a potential entry point could be around the current market price or slightly below, especially if the price dips towards the $16.50-$16.75 range.

- 6-Month Target Price: With the company’s robust financial performance and the stock trading below its 200-day SMA of $21.54322, a 6-month target price in the range of $20-$22 seems attainable. This prediction assumes continued revenue growth and favorable market conditions.

- Long-Term Outlook: The increasing demand for cloud networking solutions and the company’s innovation in AI and machine learning position Extreme Networks for potential long-term growth. If the company continues its current growth trajectory, the stock could see further appreciation over the long term, potentially reaching or surpassing its previous highs.

Future Prospects and Potential:

- Growth in Cloud Networking: With the surge in cloud solutions, Extreme Networks is poised for growth in the cloud networking segment.

- Innovation and Expansion: Their focus on AI and machine learning for network solutions indicates potential for future growth and expansion in new markets.

Risks and Challenges:

- Competitive Industry: The technology and communications industry is highly competitive, with rapid changes in technology and customer preferences.

- Global Economic Factors: External economic factors can impact IT spending, affecting the company’s performance.

- Market Volatility: Being in the tech sector, the company is susceptible to market volatility, which can lead to fluctuations in stock prices.

Conclusion: Extreme Networks presents an intriguing investment opportunity, particularly for those interested in the technology and cloud networking sector. The company’s robust financial performance, coupled with its innovative solutions and global presence, make it a compelling choice for investors. However, potential investors should be mindful of the inherent risks and market volatility associated with the tech sector.

Above analysis is generated by GPT “Stock Picks in AI Industry”!